Saun-ic Boom

How retailers can respond to skyrocketing sauna sales

Sauna sales are up like never before, with roughly 1.5 million U.S. households now owning saunas and adoption growing at about 5% annually as more consumers invest in at-home wellness. Residential saunas accounted for nearly 60% of market share in 2024, and North American sauna revenue topped $255 million in the same year, according to industry research.

“Wellness moved from a ‘nice-to-have’ to an essential part of daily life,” says Mark Boulding, vice president of marketing and growth at Leisurecraft in Oakville, Ontario, Canada.

Owing to a strong shift toward home-based wellness experiences, Boulding says saunas became a natural investment for customers.

“Credible research around cardiovascular health, mental well-being, sleep and longevity gave saunas scientific legitimacy,” Boulding says.

The U.S. sauna market is set to increase by $151.3 million, at a compound annual growth rate of 6.4% between 2024-29, according to a market research report from Technavio. The expanding popularity of infrared and portable models has also opened the category to new consumers, further accelerating growth.

Boulding says social media influencers have normalized sauna use and sparked curiosity, but customers still rely on trusted retailers and manufacturers to validate claims and guide decisions.

“Awareness may start online, but confidence is built through education,” Boulding says.

Kathi Belcourt, director of sales and service at Aqua-Tech Pool, Spa and Whole Home Renovations in Winnipeg, Manitoba, Canada, says saunas attract new clients and often lead to cross-category sales in pools, hot tubs and other home wellness products.

This boom feels different: it’s holistic and rooted in the science of living better, not just luxury. The conversation is about proactive health, mental clarity and daily rituals — well beyond simple relaxation.”

Kathi Belcourt, Aqua-Tech Pool, Spa and Whole Home Renovations

“We’re seeing a wave of entirely new customers,” Belcourt says. “People who may have never considered a sauna before but are now drawn in by wellness trends, influencer recommendations and the desire to create a ‘staycation’ destination at home.”

Belcourt adds that margins are strong for saunas and hot tubs, but saunas typically require less after-sales service, letting retailers build long-term customer relationships across a broader product mix.

“This boom feels different: it’s holistic and rooted in the science of living better, not just luxury,” Belcourt says. “The conversation is about proactive health, mental clarity and daily rituals — well beyond simple relaxation.”

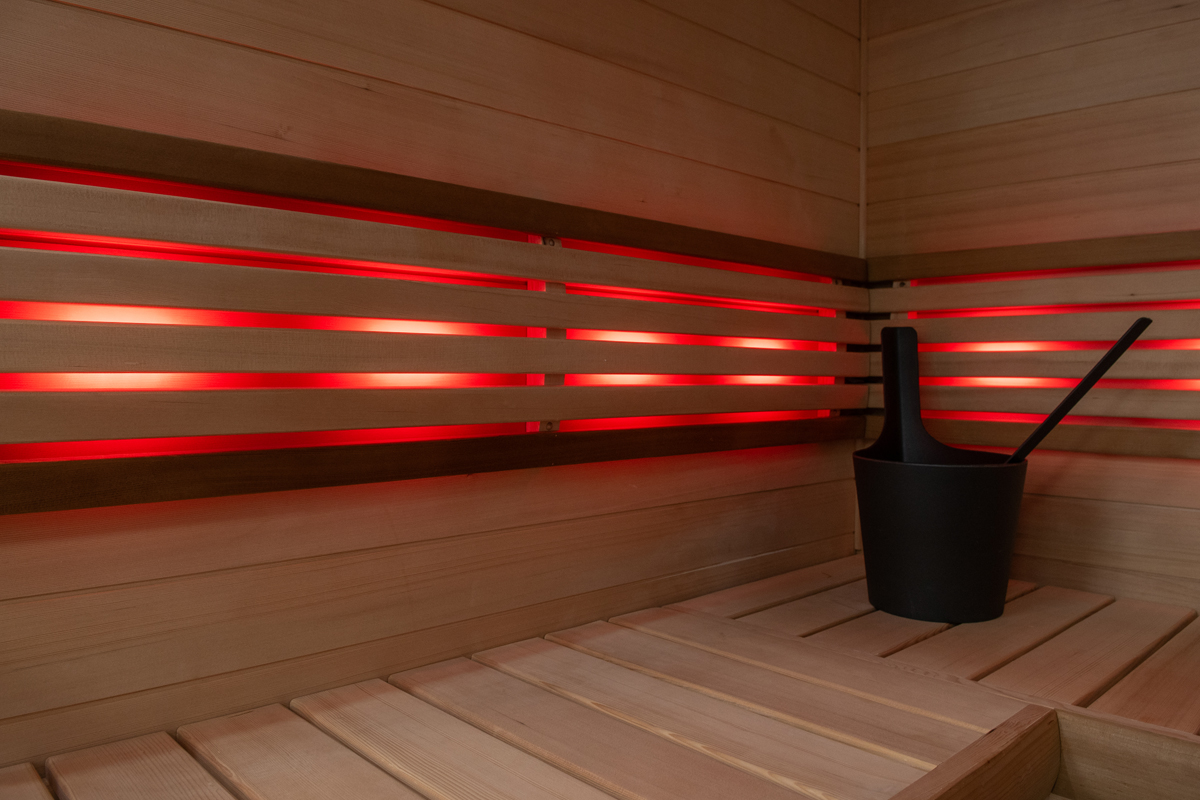

Belcourt says many customers also show interest in the tradition of Finnish saunas and are well-educated on the usage and benefits they want.

First-time buyers, Boulding says, include demographics who historically never considered saunas: young families, longevity-focused professionals, athletes, biohackers and homeowners with limited outdoor space.

“Saunas are no longer niche; they’re mainstream,” Boulding says. “This isn’t a spike — it’s a structural shift. Saunas are aligning with broader movements in preventative health, mental wellness and lifestyle design, which gives this growth far more staying power.”

Kevin Thompson, general manager of The Spa and Sauna Co. in Reno, Nevada, has been selling saunas for 18 years and says their smaller footprint gives them an advantage over hot tubs.

“Saunas are a lot more obtainable for the masses than hot tubs are,” Thompson says. “You can’t put a 7-foot-by-7-foot hot tub on the balcony of a lot of high-rise buildings in New York. So the smaller footprint units are definitely the most popular.”

Saunas are a lot more obtainable for the masses than hot tubs are. You can’t put a 7-foot-by-7-foot hot tub on the balcony of a lot of high-rise buildings in New York. So the smaller footprint units are definitely the most popular.”

Kevin Thompson, The Spa & Sauna Co.

Outdoor sauna interest has also climbed, he notes, with the surge in barrel sauna popularity lifting the entire category.

Both indoor and outdoor segments are thriving, Boulding adds, but family-sized models often win out as customers shift from personal wellness to shared experiences.

Belcourt says they’re also seeing a healthy mix of sales with large and small units, but there’s a distinct trend toward family-sized models.

“Infrared and outdoor barrel saunas are leading the charge, but there’s growing interest in customizable indoor kits as people look to personalize their wellness spaces,” Belcourt says. She also notes rapidly rising interest in cold plunges.

“Many clients want the full contrast therapy experience — sauna followed by cold plunge — to maximize wellness benefits,” Belcourt says. “Many are also incorporating a hot tub into the mix.”

Know your client’s needs

Retailers interested in adding saunas to their showrooms should focus on existing customer needs. Belcourt recommends curating a lineup that matches the goals and wellness habits of current and past clients.

“Focus on education and client care,” she says. “Providing resources about the science and benefits of sauna use, offering personalized consultations and showcasing real-life success stories can turn interest into sales.”

Retailers can also offer cross-category product experiences to customers, like a sauna and cold plunge test.

“A client can pop in and try the experience for themselves,” Belcourt says. “Once they have a sweat, then a plunge, then warm back up in hydrotherapy, you would be amazed at how excited they are to start their wellness partnership with us.”

Clarifying expectations for installation and maintenance, casting vision for how a sauna can transform a customer’s wellness routine and offering add-ons and accessories for saunas such as scents, bench accessories, heater rocks, replacement parts and future upgrades all create long-term customer relationships and boost margins.

Partner with reputable suppliers and manufacturers

For retailers new to the sauna category, Thompson advises choosing manufacturers or suppliers wisely. He says having access to parts and the ability to fix a sauna are important, and retailers need to be comfortable working with a brand they know can support them and their customers.

“You want to deal with somebody who’s credible and has some longevity,” Thompson says. “Be cautious about what you carry, vet your manufacturer, make sure that they have a long-standing history and know where your price points hit competitively.”

And competitive pricing doesn’t just mean competitors down the street. “Online will typically be cheaper, but cheaper isn’t always better,” Thompson says.

A manufacturer that provides marketing materials, training and support will add value and credibility to retailers where impersonal online shopping can’t.

Know what you’re talking about

Boulding, Belcourt and Thompson emphasize the importance of ongoing education, product knowledge and client care training to help sales teams stand out.

“Staff should feel like wellness partners, not just salespeople,” Belcourt says.

Thompson says even seasoned sellers benefit from continuous learning. “Sometimes, it’s good to be interested in [something new] they are telling you — and for you to not be a know-it-all,” Thompson says.

Retailers should commit to education, choose quality partners and think long-term, Boulding adds. “Saunas reward retailers who invest in expertise, not just inventory,” he says. “Retail staff should be trained to sell saunas as wellness solutions, not just products.”

Training should include clear distinctions between traditional, infrared and hybrid saunas, as well as a grounded understanding of how sauna use supports stress reduction, sleep and recovery — without making medical claims. “Well-trained staff build trust, close sales more naturally and create long-term customer relationships, making training one of the highest-ROI investments a retailer can make,” Boulding says.

Retailers should guide customers through the decision process by asking questions, having a basic understanding of installation and logistics to build buyer confidence and positioning accessories and upgrades as experience enhancers — not upsells.

Saunas are not a trend chasing attention. They are a return to something deeply human.”

Mark Boulding, Leisurecraft

“Saunas are not a trend chasing attention,” Boulding says. “They are a return to something deeply human.”